China has emerged as a dominant player in the electric vehicle (EV) market, particularly in terms of supply chains, technology, and cost advantage, all of which have contributed to China’s rise in the industry.

China has emerged as a dominant player in the electric vehicle (EV) market, particularly in terms of supply chains, technology, and cost advantage, all of which have contributed to China’s rise in the industry. China currently holds the title of the world’s largest consumer and EV battery producer, and plays a crucial role in driving the global transition to EVs. China’s ambitious policies and incentives have also propelled the rapid development of its EV industry, which aims to combat air pollution and reduce dependence on fossil fuels.

This article explores the Chinese government’s policies and incentives in the EV sector, presents data on the EV market and export of EVs in China, and highlights the available business opportunities.

Policies and Incentives

The Chinese government has actively promoted the development and adoption of electric vehicles by implementing various policies, including financial incentives, subsidies, and regulations, to encourage the production and purchase of EVs. These policies have greatly contributed to the rapid growth of the EV market in China.

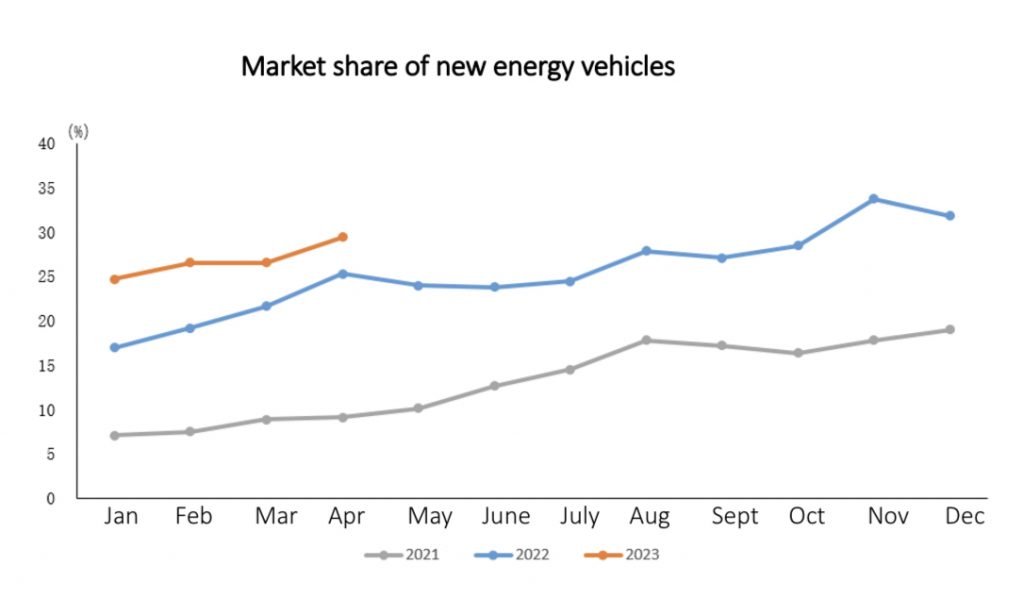

China’s “New Energy Vehicle Industry Development Plan (2021-2035)” has set ambitious goals for the development of new energy vehicles (EVs). By 2025, the plan aims for pure electric vehicles to account for over 30% of the market share, with a minimum energy density of 160 Wh/kg and a range exceeding 300 kilometres. Pure electric vehicles are also expected to make up more than 50% of total EV sales.

In 2009, subsidies were introduced to promote EV development, address environmental concerns, and combat air pollution. The subsidy policy underwent adjustments over the years, with increasing thresholds and a gradual reduction in intensity. The national subsidy policy was officially terminated at the end of 2022, but data suggests that the market continued to experience positive development. The number of registered EV-related companies increased significantly, and independent brands such as BYD, Xpeng, and NIO gained consumer recognition.

While the withdrawal of national subsidies may have some impact, local governments have introduced stimulus measures to support EV demand. These measures include cash subsidies, free parking, and the issuance of auto consumption coupons. Cities such as Ningbo, Zhengzhou, Shanghai, Shandong Province, and Wuxi City have implemented various incentives to encourage car purchases and boost EV demand.

The 65th batch of new energy vehicle tax exemption catalogs was released in 2023, comprising of a diverse range of 316 models eligible for tax exemption. This demonstrates the availability of a wide selection of EVs for consumers. China is not only implementing stimulus measures to support electric vehicles (EVs) but has also committed to creating a supportive regulatory environment. The Ministry of Industry and Information Technology spokesperson announced plans to ensure a stable supply of core components, fund the development of charging infrastructure, and establish stricter rules for EV production licenses. Additionally, they aim to complete the regulatory framework for battery recycling, emphasising the comprehensive approach China has adopted to promote the growth and sustainability of the EV industry.

Overall, China’s EV industry has made significant progress, transitioning from a policy-driven market to a more market-driven one. The market has shown resilience and consumer acceptance of EVs, mitigating the negative impact of subsidy reductions. With the supportive policies, incentive programs, and continued technological advancements, China’s EV market is expected to continue growing over the coming years.

EV Market Data

Domestic Market

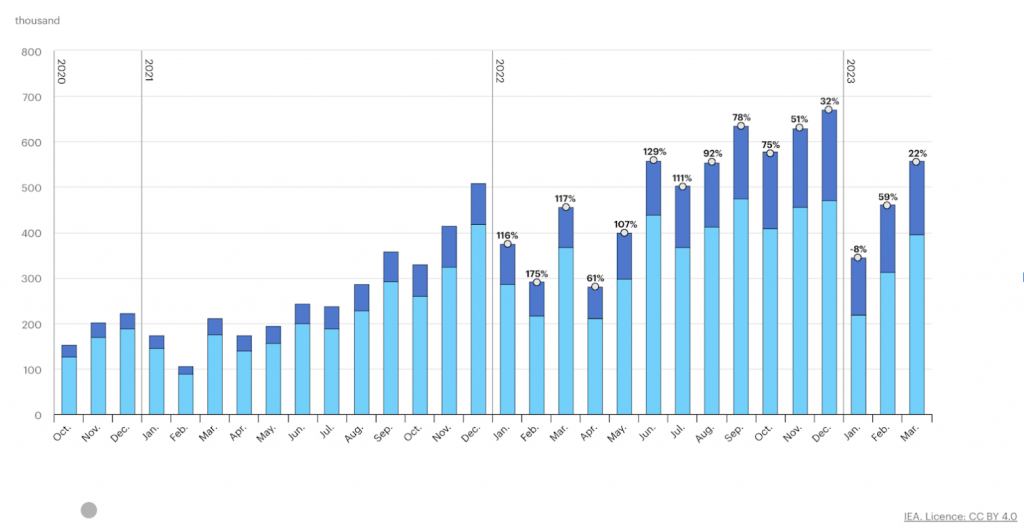

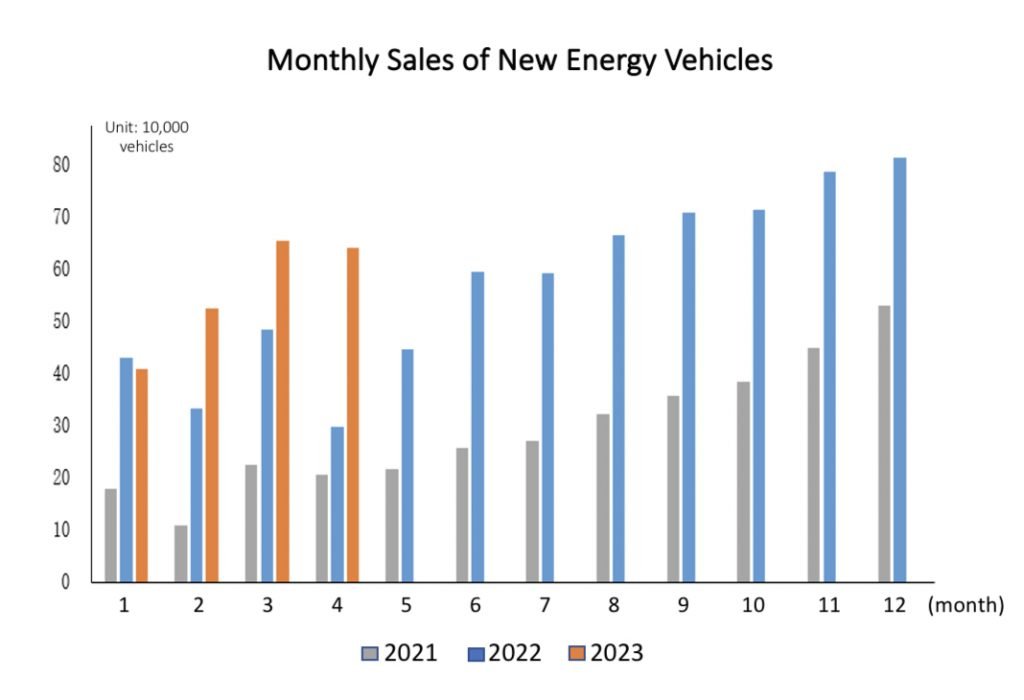

International Energy Agency data showed that electric car sales, particularly battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), have continued to rise globally, with China’s sales in the lead. In 2022, BEV sales in China increased by 60% compared with the previous year, reaching 4.4 million units, while PHEV sales nearly tripled to 1.5 million units. The growth in BEV sales in China was significant, having tripled from 2020 to 2021 after experiencing moderate growth from 2018 to 2020. Despite a 3% decline in total car sales in 2022, electric car sales have showed an overall upward trend in the past two years.

Electric car sales experienced a decline in January 2023, partly due to the timing of Chinese New Year, and were nearly 10% lower than sales in January 2022. However, sales rebounded in February and March 2023, surpassing sales from the same months in the previous year by around 60% and 25%, respectively. As a result, the first quarter of 2023 saw electric car sales reach a total more than 20% higher than the first quarter of 2022.

According to a statistical analysis undertaken by the China Association of Automobile Manufacturers, in April 2023 the sales of new energy vehicles reached 636,000, marking an average year-on-year increase of 1.1 times. The market share reached around 29.5%. Among the main types of new energy vehicles in the same month, there were slight decreases in the production and sales of pure electric vehicles compared with the previous month. The production of plug-in hybrid electric vehicles also slightly decreased, while sales increased. On the other hand, the production of fuel cell vehicles increased slightly, but sales decreased significantly. From January to April 2023, all three major new energy vehicle categories demonstrated varying degrees of growth in production and sales compared to the same period from the previous year.

Overall, the data indicates a positive trend in the production and sales of new energy vehicles, despite some fluctuations within specific categories. Although there were slight decreases in the production and sales of pure electric vehicles in April 2023 compared with the previous month, the overall market performance shows significant year-on-year growth.

Export Market

The penetration rate of new energy vehicles worldwide has generally shown a rapidly increasing trend. It reached 17% in the fourth quarter of 2022 and 13% in the first quarter of 2023. Among these figures, China had a penetration rate of 25%, followed by Germany and Norway with 18%, the United States with a much lower penetration rate of 8.8%, and Japan with a rate of only 3%.

New energy vehicles have become a key point of growth for China’s auto exports. In 2020, the export of new energy vehicles was 224,000 units. This number increased to 590,000 units in 2021 and reached a cumulative export of 1.12 million units in 2022. Data from the China Association of Automobile Manufacturers shows that in April 2023, China exported 100,000 new energy vehicles, representing a month-on-month increase of 28.6% and a year-on-year increase of 8.4 times. These exports accounted for 26.6% of the total vehicle exports for that month. During the first four months of 2023, China exported 348,000 new energy vehicles, experiencing a year-on-year increase of 1.7 times. The strong export performance of new energy vehicles in China is attributed to its robust industrial chain and the combination of a strong domestic market and increased export growth.

The data suggests a global increase in new energy vehicle adoption, albeit with varying rates in different countries. China stands out with the highest penetration rate, indicating its strong development and adoption of electric vehicles (EVs). The country is leading the global market in new energy vehicle adoption, positioning Chinese automakers and technology companies at the forefront of EV development and innovation. This provides opportunities for domestic manufacturers to gain market share, invest in research and development, and further strengthen their position in the global EV market.

The UK’s Advantages in the EV Sector

The UK has a long-standing history in the automotive industry, with a strong manufacturing base and a skilled workforce. This expertise provides a solid foundation for the production of electric vehicles. The presence of renowned automakers, research institutions, and engineering companies in the UK contributes to the development and innovation of EV technology. In the EV sector, the UK excels in areas such as advanced engineering, battery technology, and electric drivetrain systems. The country has several research and development centres focused on electric vehicle technology, which drive advancements in battery efficiency, range, and charging infrastructure.

The UK government has been actively promoting the adoption of electric vehicles through supportive policies and incentives. Initiatives such as grants, tax exemptions, and subsidies for EV purchases, as well as investments in charging infrastructure, encourage the growth of the EV market. The government’s commitment to phasing out internal combustion engine vehicles by 2030 further emphasises its dedication to the EV sector. It has been expanding its charging infrastructure network, including both public and private charging points. The government has committed to investing in the development of a robust and accessible charging infrastructure across the country. This commitment ensures that EV owners have convenient access to charging facilities, supporting the widespread adoption of electric vehicles.

The UK is actively transitioning towards renewable energy resources, such as wind and solar power. This shift towards clean energy aligns with the goal of reducing carbon emissions in the transportation sector. EVs charged with renewable energy contribute to a greener and more sustainable transportation system. The country has witnessed a steady increase in consumer demand for electric vehicles. As more and more individuals and businesses become environmentally conscious and seek sustainable transportation options, the demand for EVs increases. This demand creates a favourable market for EV manufacturers and encourages investment in the sector.

Business Opportunities in the Chinese EV Market for UK-China Collaboration

China’s electric vehicle (EV) market has experienced significant growth due to government support, policy incentives, and the emergence of domestic EV brands tailored to Chinese consumers. The adoption of EVs in China addresses environmental, energy, and economic concerns. China’s control over key battery materials gives it a strategic advantage in the EV sector. Advancements in battery technology have made EVs more affordable, surpassing the cost of internal combustion engine (ICE) cars. China’s dominant position in the EV supply chain and ongoing technological innovations have driven rapid sales growth, primarily at the expense of ICE cars.

Despite the termination of national subsidies, the Chinese EV market continues to develop positively, presenting many business opportunities. As the market shifts to a market-driven approach, companies need to adapt and focus on innovation, cost-effectiveness, and customer experience. Collaboration between China and the UK in research projects and academic partnerships would be mutually beneficial, particularly in areas such as battery technology and autonomous driving.

To support the growing EV fleet, China needs to invest in charging infrastructure. An opportunity for collaboration between the UK and China is in the development of charging infrastructure and smart grid solutions. Sharing knowledge and best practices could accelerate the deployment of efficient charging networks, battery swapping technologies, and smart grid integration.

China is the leading player in global EV production, with a well-established supply chain. Collaborative efforts between China and the UK should focus on establishing a robust supply chain and leveraging expertise in advanced engineering and component manufacturing.

The EV market in China is expected to continue expanding as technology improves, costs decrease, and environmental awareness increases. Focusing on sustainability and circular economy principles will align with China’s regulatory environment and provide companies with a competitive advantage.

China and the UK can create a mutually beneficial partnership in the EV market by leveraging their strengths and resources. Collaboration in technology, manufacturing, supply chain, infrastructure, and research can help drive innovation, market growth, and sustainable transportation solutions.

References:

- http://data.cpcaauto.com/FuelMarket

- http://www.caam.org.cn/chn/12/cate_130/con_5235859.html

- https://technode.com/2023/02/01/local-chinese-authorities-unveil-stimulus-measures-to-spur-ev-sales/

- https://www.iea.org/reports/global-ev-outlook-2023/trends-in-electric-light-duty-vehicles

- China’s lead in electric vehicles is unassailable, South China Morning Post.

- How did China come to dominate the world of electric cars? MIT Technology Review.